MARCHAMO TIME

Illiana Granados Gamboa, Insurance Broker, Seguros Metropolitanos. Tel. (506) 8998-8102.

Every year, all vehicle owners must pay the famous Marchamo, commonly referred to as the Circulation Right. Anyone can pay for the marchamo by simply providing the license plate number; it doesn’t have to be paid by the owner of the vehicle.

When you pay the marchamo in Costa Rica, you will get a paper receipt that shows what you are paying for on one side and the tag number and the year of payment on the other side, which you stick on the windshield. Every year you will receive a different color sticker so that the traffic police can see at a distance if you have this year’s sticker or not. If you don’t the traffic police will stop you, check your papers and give you a fine if you’re not paid up to date.

When you pay the marchamo in Costa Rica, you will get a paper receipt that shows what you are paying for on one side and the tag number and the year of payment on the other side, which you stick on the windshield. Every year you will receive a different color sticker so that the traffic police can see at a distance if you have this year’s sticker or not. If you don’t the traffic police will stop you, check your papers and give you a fine if you’re not paid up to date.

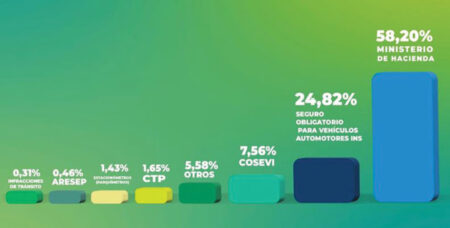

The Marchamo or Circulation Right, which all motor vehicle owners must be paid annually by December 31, and is composed of the following items:

- Mandatory Motor Insurance (SOA)

- Contribution to the Road Safety Council

- Sales Tax on SOA

- Vehicle Property Tax

- Traffic Law Violations

- Parking Meters

- Tax in favor of Municipalities

- ARESEP (Buses and Taxis) Public Transportation Canon (CTP) (Buses and Taxis)

- Fauna Stamp and Scout Stamp

It is important to emphasize that, of the total collected for the Circulation Right or Marchamo, the amount corresponding to SOA represents less than 20% of the total cost, with the vehicle property tax being the item that represents the highest percentage (more than 70% of the total cost). It is worth noting that the percentage may vary because the Marchamo includes payment for violations and parking meters, which could reduce the percentage corresponding to SOA.

What does SOA cover?

The Mandatory Automobile Insurance (SOA), created by the Traffic Law, aims to cover injuries or deaths of individuals involved in a traffic accident.

In accordance with Article 64 of the Traffic Law (No. 9078), SOA covers injuries and deaths of individuals involved in traffic accidents, whether or not the driver is at fault. It also covers injuries and deaths in accidents with civil liability arising from the possession, use, or maintenance of the vehicle; in this case, liability must be determined by the competent judicial authorities.

The benefits covered by SOA include medical, surgical, hospital, pharmaceutical, and rehabilitation assistance, as well as prosthetics and medical devices needed to correct functional deficiencies. It also provides cash benefits for compensation for temporary or permanent disability or death, as detailed in this law. Other covered expenses include transportation costs under the terms and conditions set out in the regulations of this law, as well as lodging and meal payments when the injured party, due to the provision of medical or rehabilitation services, must move to a location other than their usual residence, and the insurance company cannot provide that service. The amount for this purpose will be set in the regulations of this law. Additionally, it covers funeral and body transport costs, according to the terms that will be established in the regulations of this law.

Currently, the only insurer that offers SOA is the National Insurance Institute.

The coverage amount corresponds to a sum of 6,000,000 colones and is “exhausted” when the cost of the benefits provided to the affected parties reaches that amount.

Can the coverage of SOA be increased?

The law establishes that the coverage of SOA doubles in the following cases:

- The injured party is not insured under the Health and Maternity Regime of the Costa Rican Social Security Fund (CCSS).

- The injured party is under eighteen years of age.

- The life of the injured party is at risk.

What does the mandatory insurance not cover?

Unlike other insurances such as comprehensive insurance, mandatory insurance does not cover damages (partial or total) to your own vehicle in case of an incident where you are found at fault.

Source: Sugese and INS.